When considering colored diamonds as an investment vehicle, most enthusiasts immediately focus on the stone's color as the primary determinant of value. While it is true that color represents a significant factor—often accounting for the initial visual appeal and a substantial portion of the price—it is far from the only characteristic that dictates a diamond's investment potential and long-term value appreciation. Astute investors and collectors understand that a truly valuable colored diamond is the sum of multiple, intricately balanced attributes. Overlooking any one of these can lead to a poor investment decision, as the market for these rare gems is nuanced and driven by connoisseurship.

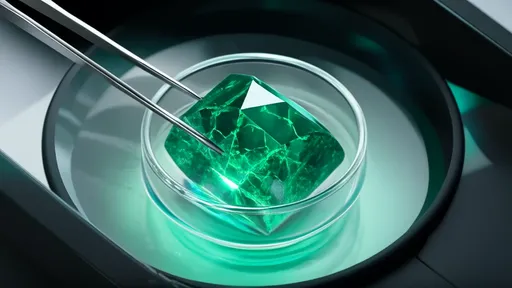

The clarity of a colored diamond is a factor that demands careful consideration, though its importance is often weighed differently than in the colorless diamond market. Inclusions—internal characteristics—can sometimes be masked or even complemented by a diamond's intense body color. A strong, vivid hue can make certain inclusions less visible to the naked eye. However, this does not mean clarity should be ignored. Heavily included stones may have structural weaknesses that affect their durability, a critical factor for a piece meant to be a store of value. Furthermore, high-clarity colored diamonds are exceptionally rare. An internally flawless fancy vivid blue or pink diamond commands a monumental premium precisely because such a combination of perfect color and perfect clarity is a geological near-impossibility. The investor must strike a balance: seeking a stone where the inclusions do not detract from the beauty or integrity of the gem, understanding that a slight compromise on clarity might be necessary to acquire a superior color, but never venturing into territory where the inclusions pose a risk.

Another cornerstone of valuation is the carat weight. In the realm of diamonds, size is not a linear but an exponential factor in pricing. This is especially pronounced with colored diamonds. A two-carat fancy intense pink diamond is not merely double the price of a one-carat stone with identical color, clarity, and cut; it can be four, five, or even ten times the price. This price-per-carat premium for larger stones exists because finding rough material with intense, even color that is also large enough to yield a substantial polished gem is incredibly uncommon. For the investor, this presents a strategic decision. Smaller carat weight stones offer a more accessible entry point into the market, but the most significant appreciation potential often lies with larger, rarer specimens. The market liquidity, however, can be higher for stones in the one-to-three-carat range, as the pool of potential buyers shrinks considerably as the price ascends into the millions for a single stone.

The role of cut is frequently underestimated by novice investors. A superb cut is not just about achieving a traditional shape or maximizing brilliance as it is with white diamonds. For colored diamonds, the cut is the artisan's tool for optimizing the color. The angles and proportions of the facets are meticulously calculated to reflect light in such a way that it travels through the stone to maximize the saturation and intensity of its hue. A poorly cut stone can "leak" color, appearing washed out or displaying undesirable color zones (areas of uneven color). A master cutter can sometimes salvage a stone with a weaker color by employing a specific cut to concentrate the hue, thereby elevating its color grade and, consequently, its value. When evaluating a potential investment, one must assess how well the cut showcases the diamond's inherent color. Does the stone look vibrant and evenly colored from all angles? The cut is the crucial intermediary between the diamond's raw potential and its finished beauty.

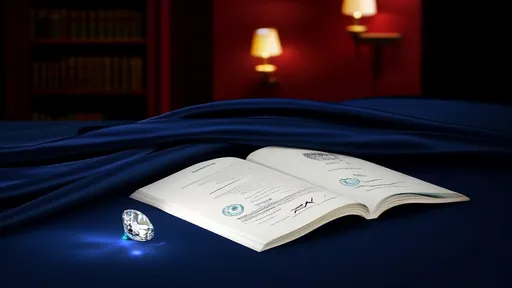

Perhaps the most complex and critical element is the diamond's origin and certification. In today's market, provenance is paramount. A diamond's geographical origin can have a profound impact on its value and desirability. For instance, pink diamonds from the now-closed Argyle mine in Australia carry a specific cachet and rarity that pinks from other locations cannot match. Similarly, certain vivid green diamonds are highly prized if their origin can be traced to specific historical mines. This leads directly to the necessity of certification. Reputable, independent gemological laboratories like the Gemological Institute of America (GIA) or the Gübelin Gem Lab provide the essential verification of a diamond's natural color, its characteristics, and often its origin. Their reports are the bedrock of trust in a high-value transaction. An investment-grade colored diamond must be accompanied by a certificate from a top-tier lab; without it, the stone's attributes and even its natural status are questionable, rendering it nearly impossible to resell at a premium on the open market.

Finally, the overarching factor that synthesizes all others is the concept of rarity and market demand. Rarity is not an isolated metric; it is the interplay of all the factors mentioned above. What is the rarity of a 5-carat, internally flawless, fancy vivid blue diamond with an excellent cut and a documented origin? It is perhaps a once-in-a-generation find. However, rarity alone is not enough; it must be paired with sustained market demand. The investment landscape for colored diamonds is shaped by global wealth, collector trends, and aesthetic preferences. While red diamonds are the rarest, intense pinks and blues have historically shown incredibly strong and steady demand from collectors across the globe, making them a potentially more liquid investment. An investor must not only acquire a rare stone but a stone whose rarity is recognized and coveted by the market. This requires staying informed about auction results, collector preferences, and macroeconomic factors that influence the appetite for luxury assets.

In conclusion, successful investment in colored diamonds requires a holistic and discerning approach. While the captivating color may be the siren's call, the wise investor will give equal, if not greater, scrutiny to the diamond's clarity, carat weight, cut quality, and its certified provenance. Understanding how these elements interact to create rarity and align with market demand is the true art of investment. It is a market that rewards knowledge, patience, and a deep appreciation for the unique natural artistry of each stone.

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025